Important things to know about share purchase deposit contract

a year ago

15:22

In order to guarantee the fulfillment of a share purchase deal, it is common for the buyer and seller to establish a share purchase deposit contract that outlines the necessary details for both parties. Keep scrolling this article to discover what you need to know about share purchase deposit contracts.

1.What is a share purchase deposit contract?

A share purchase deposit contract is a legal agreement between a buyer and a seller to ensure the performance of a share purchase. Accordingly, the buyer will reserve their right to buy the shares by providing an initial amount of money as a form of security, and the seller is then responsible for delivering the shares to the buyer under the agreed conditions. In essence, the deposit contract is a form of agreement to bind the involved parties to perform their share purchase transaction.

In a share purchase deposit contract, the two primary parties involved are the depositor (buyer, investors) and the depositary (companies). The buyer can be an individual or an entity who is interested in acquiring the ownership of the shares in the company. The other party (the seller) is the issuing company that is seeking additional capital through offering its shares to investors.

A share purchase deposit contract guarantees the performance of civil obligations of the seller and the buyer in a share purchase.

Normally, share purchase deposit contracts are established prior to the purchase. The involved parties can either choose to make a separate deposit contract or include the deposit terms in the official purchase contract. In the case the deposit agreement is established into an independent contract, it should outline the terms and conditions related to the deposit details and sets out the specific rights and obligations of both parties.

2.Common sections in a share purchase deposit contract

Although making a deposit might be a simple process, the deposit contract should not be overlooked and must be carefully discussed by the involved parties. The specific terms and conditions included in a share purchase deposit contract or any other type of deposit contract will typically contain these following main sections:

a) Purpose of deposit:

When drafting a deposit contract, the involved parties need to clearly state the purpose of the deposit in the agreement. Typically, a deposit is applied for two main purposes:

- To secure both parties entering into a share purchase contract.- To guarantee both parties duly perform the share purchase contract that has been entered into.

In the case of a share purchase transaction, the share purchase deposit contract should determine the main purpose is whether to ensure both parties sign the main purchase contract or the parties commit to perform the transaction as agreed in the established share purchase contract. This is to avoid unwanted situations where one party of the transaction withdraws or does not comply with the agreed terms and conditions.

In addition, the details of the purchase may also be identified in the deposit contract, including information such as the number of shares being purchased and the sale price of the shares. This helps the involved parties secure the mutual agreement on the exact number of shares in the transaction and avoid misunderstandings or unwanted disputes later on.

The involved parties should discuss thoroughly on the specific terms and conditions in the share purchase deposit contract.

b) Subjects of deposit:

The subject of deposit is the property that the involved parties use to place the deposit. This is the primary element that a share purchase deposit contract must provide, including details about the deposit such as deposit amount, the payment method and other information regarding the remaining payments and their schedule.

When negotiating an appropriate property to be used as a deposit, the involved parties should also consider several factors. According to Article 328 of the Civil Code 2015, the subject of deposit is "a sum of money or precious metal, gemstones or other valuable object". This means the eligible deposited assets are restricted to a specific range of money and other valuable properties that can be easily assessed by the depositary. In addition, the deposit property must also belong to the depositor or be owned by someone else, their consent to use it for deposit.

Besides the deposit amount, the share purchase deposit contract may outline the subsequent payment arrangements (such as due dates and amounts) that the buyer is obligated to make to complete the purchase transaction. It is important for the buyer and the seller to determine a suitable condition for the buyer to fulfill their obligation to acquire the designated shares.

c) Settlement of deposit:

Normally, the deposit between buyer and seller will just be keeped for a certain period of time until both parties enter into the main contract or perform their obligations. After the deposit contract has been fulfilled, the deposit amount will be handled depending on the agreement of the involved parties.

Typically, there are two approaches in handling the deposit amount. The first treatment involved returning the deposit to the buyer after they successfully complete the payment for the share purchase. On the other hand, the involved parties may agree that the deposit will be deducted from the total money the buyer needs to pay for the acquired shares. In this case, the deposit serves as a partial payment towards the purchase price and the buyer is only required to pay the remaining balance.

Based on the demand and intention of both parties, the seller and the buyer may explicitly specify the suitable treatment towards the deposit amount in the share purchase deposit contract.

d) Obligations and rights of involved parties:

According to Article 37 Decree 21/2021/ND-CP on elaborating the Civil Code, the rights and obligations of the depositor and the depositary may include the following details:

Depositor’s rights and obligations:

- Delivering the property or the deposit amount to the depositary immediately upon signing the deposit contract.

- Requesting the depositary to stop using the deposited property and preserve the deposited properties so that the deposited property from losing value.

- Exchanging and replacing the deposited properties or use the deposited properties in other civil transactions if the depositary agrees.

- Paying the deposit reasonable expenses for preserving the deposited property.

- Carry out the registration of property ownership for the depositqry to own the deposited property.

Depositary’s rights and obligations:

- Requesting the depositor to terminate the exchange and replacement of the deposited property without the consent of the depositary.

- Possessing of the deposit property in case the depositor violates the commitment on signing and performing the contract.

- Preserving deposit properties.

- Refraining from extracting and using the deposited property without the consent of the depositor.

3.Frequently asked questions about deposit contract

a) Under what circumstances is a deposit contract considered invalid?

Deposit contracts is a form of civil contract, therefore, this type of contract will be governed by the Civil Code. According to Article 407 and Article 408 of the 2015 Civil Code, a civil contract will be considered as invalid in the following cases:

- One party loses or has limited civil act capacity or does not voluntarily participate in the signing of the deposit contract or the main contract.

- The contract has the purpose and terms that violate prohibited provisions of the law or go against social ethics.

- The Deposit Contract is invalid due to forgery (to conceal another contract), misunderstanding and deception or coercion.

- The subject of the contract is impossible to perform.

b) When is a deposit contract considered valid?

Referring to Article 117 of the Civil Code 2015, a deposit contract will be considered valid when the following conditions are met:

- Participants in the transaction have legal personality and/or legal capacity in conformity with such transaction.

- Participants in the transaction act entirely voluntarily.

- The purpose and contents of the transaction are not contrary to the law and/or social ethics.

c) Is a deposit contract required to be notarized?

The current Civil Code 2015 also does not specify that deposit contracts are required to be notarized or authenticated. The involved parties can freely agree on whether to notarize the contract or not. However, in order to avoid disputes and difficulties in the settlement process when disputes arise, the deposit contract should be notarized by a competent authority.

d) What are the legal regulations for the settlement of the deposit amount?

Regarding the settlement of the deposit amount whenever the deposit contract is violated, if the involved parties do not specify clearly in the contract, the Article 328 of Civil Code 2015 provides regulations concerning this matter as follows:

- Upon a contract being entered into or performed, any deposited property shall be returned to the depositor, or deducted from the amount of an obligation to pay money.

- If the depositor refuses to enter into or perform the contract, the deposited property shall belong to the depositary.

- If the depositary refuses to enter into or perform the contract, it must return the deposited property and pay an amount equivalent to the value of the deposited property to the depositor, unless otherwise agreed.

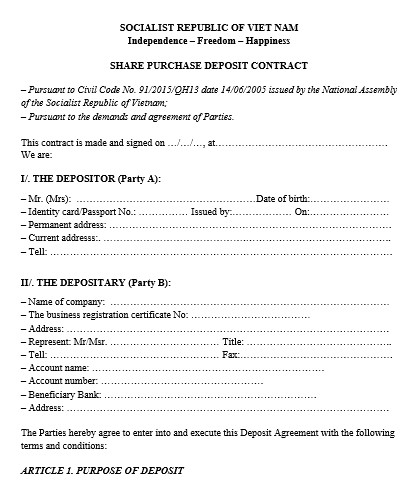

4.Share purchase deposit contract sample

Vietnamese law does not provide a specific sample of share purchase deposit contracts. The buyer and the seller can draft the contracts on their initiative, as long as these terms and conditions do not violate the general laws and regulations.

It is suggested that the involved parties get advice and guidance from a trusted legal counsel with experience in share transactions. For reference, investors and companies can refer to the sample provided below to gain an overview of which details should be specified in the share purchase deposit contract.

Share purchase deposit contract for reference

Conclusion

A share purchase deposit contract is an important document in a share purchase that guarantees the commitments of the involved parties in performing the agreed transaction. However, to establish a fair and reasonable deposit contract, it is recommended for both the buyer and the seller to seek legal advice from reputable professionals, hence ensuring a smooth and safe transaction.

Join MMatch - the business trading platform of INMERGERS to connect with potential businesses, investors and receive legal advice to maximize profit from your investment.